Outlier Insights Week of 2Oct

- Erik esInvests

- Oct 9, 2022

- 2 min read

Here's the Outlier Insights Newsletter from last week. Want the current one? FREE sign up here to get them EVERY SUNDAY at 2:02pm PT!

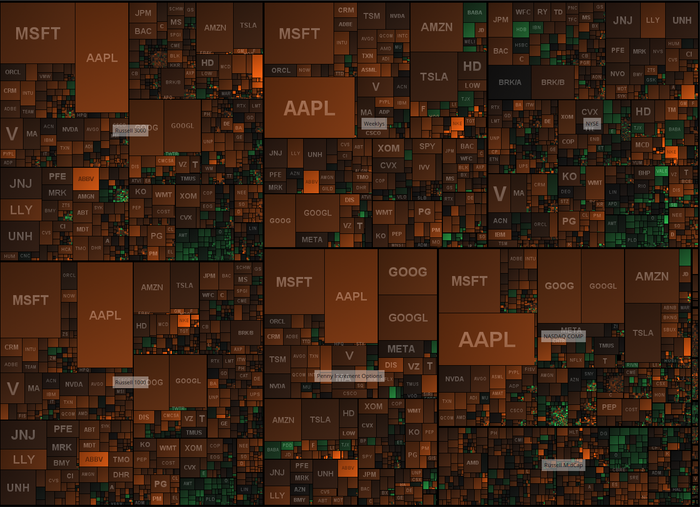

Sea of Red

esInvests Updates.

How's your trading year going? It's been boring and slow for me. I'm up just shy of 8%, here are 3 things working for me.

Scanning for short trades and opportunity analysis with the Outlier Trading Bootcamp, check it out here!

Trading & Market Commentary.

Fed speakers lookin' like the Avengers

We had multiple Fed speakers this week, however the message was relatively unanimous. Rate raises will continue until morale improves until there's a decisive indication that inflation is contracting.

There's some dissent in the Fed regarding just what rate raises make the most sense and when. We're seeing a dramatic shift in target rate probabilities that once heavily favored a 75bps increase now near a 50/50 split between 75bps and 50bps.

Pressing the Gas

As I noted above, I'm having a slower year and need to get to work. I'm less concerned with the remaining months within the year and far more concerned with taking advantage of the current markets. I've been watching very closely to get a sense of the markets and feel that there's sufficient opportunity to pursue. I'll keep a close eye on (3) things going forward: 1. IV expansion plays; 2. IV regression trades; 3. Market bottoms and the leaders emerging into the next secular move.

My trade management

No big shifts in my IWM position, I'm still short (10) of the 21Oct 164P @ 3.29

In XHB, I bought the 30Sep 53P on Monday and unwound on Tuesday for a tidy profit. The trade was predicated on expanding IV into the New Starts announcements.

In SPY, I rolled my 3Oct 398P to 31Oct 397P for a $25 credit. Main objective is regaining spot sensitivity to unwind (so I can kick off the $250K series on a blank slate). Without that objective, I would manage this position slightly differently.

link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link link